Homegrown 25G Chips Help Cisco Hold The Switch Line

by Timothy Prickett Morgan at The Next Platform

How much of a premium do you think that networking behemoth Cisco Systems plans to charge for its 25G Ethernet switches compared to their 10G predecessors? How does zero grab you? Or even less than zero?

How much of a premium do you think that networking behemoth Cisco Systems plans to charge for its 25G Ethernet switches compared to their 10G predecessors? How does zero grab you? Or even less than zero?

That’s the plan, and this is surprising but competition will do that. Considering the profit margins that Cisco shoots for and has historically attained, you might be thinking that the company would be willing to walk away from deals, or at the very least switch to merchant silicon and get into a price war with its growing ranks of rivals in datacenter switching to protect its market share.

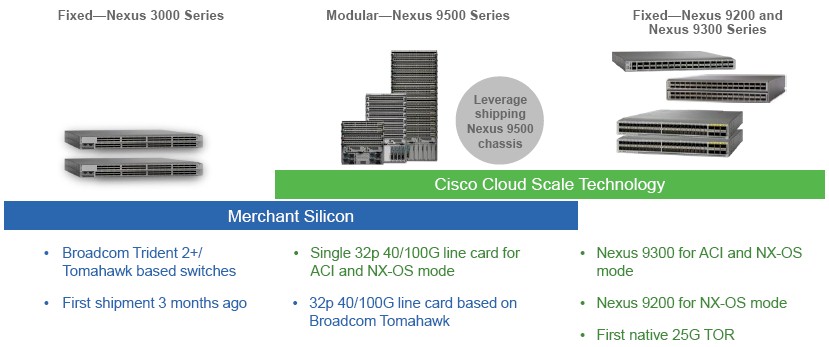

The company’s strategy is a bit more sophisticated than that, and so are its customers, as it turns out. Cisco has embraced merchant silicon chips from rival Broadcom to appease certain – and mostly hyperscaler – customers who have standardized on its “Trident-II” and “Trident-II+” chips for 10 Gb/sec and 40 Gb/sec products and who are adopting the “Tomahawk” follow-ons to them for 25 Gb/sec, 50 Gb/sec, and 100 Gb/sec gear. The Tomahawks are starting to ship from a number of switch makers, including Cisco. But don’t get the wrong idea. Cisco is still very much interested in etching its own switch chips, and this week is bringing out its own Cloud Scale family of switch ASICs that it says are better than the Broadcom Trident and Tomahawk alternatives.

Perhaps more surprising is that Cisco is going to be very aggressive on price – charging the same for 25G gear using its own chips that it charged for 10G switches also using its own chips and competitively priced against Broadcom-based machines.

Category: News